SCHEDULE 14A(RULE 14a-101)INFORMATION REQUIRED IN PROXY STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULESchedule 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Partyparty other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement |

| ☐ | Confidential, for |

| Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material |

IPSIDY INC.

authID Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

| ☒ | No fee | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | ||

| 0-11 | ||

IpsidyauthID Inc.

20212023

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

December 29, 2021*, 2023

at 10:00 a.m. Eastern Time

Virtual Meeting to be Held by Webcast

IpsidyauthID Inc.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 29, 2021*, 2023

The 20212023 Annual Meeting of Stockholders (the “Annual Meeting”) of IpsidyauthID Inc. (“Ipsidy”authID” or the “Company”) will be held virtually by webcast, on December 29, 2021,*, 2023, at 10:00 a.m. Eastern Time, to consider the below proposals. DueAs in recent years, in order to the public healthprovide safe and expanded access, improved communication, reduced environmental impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our employees and stockholders,cost savings, the Annual Meeting will be held in a virtual meeting format at https://edge.media-server.com/mmc/p/afo9uvqp.ki9r33k7.

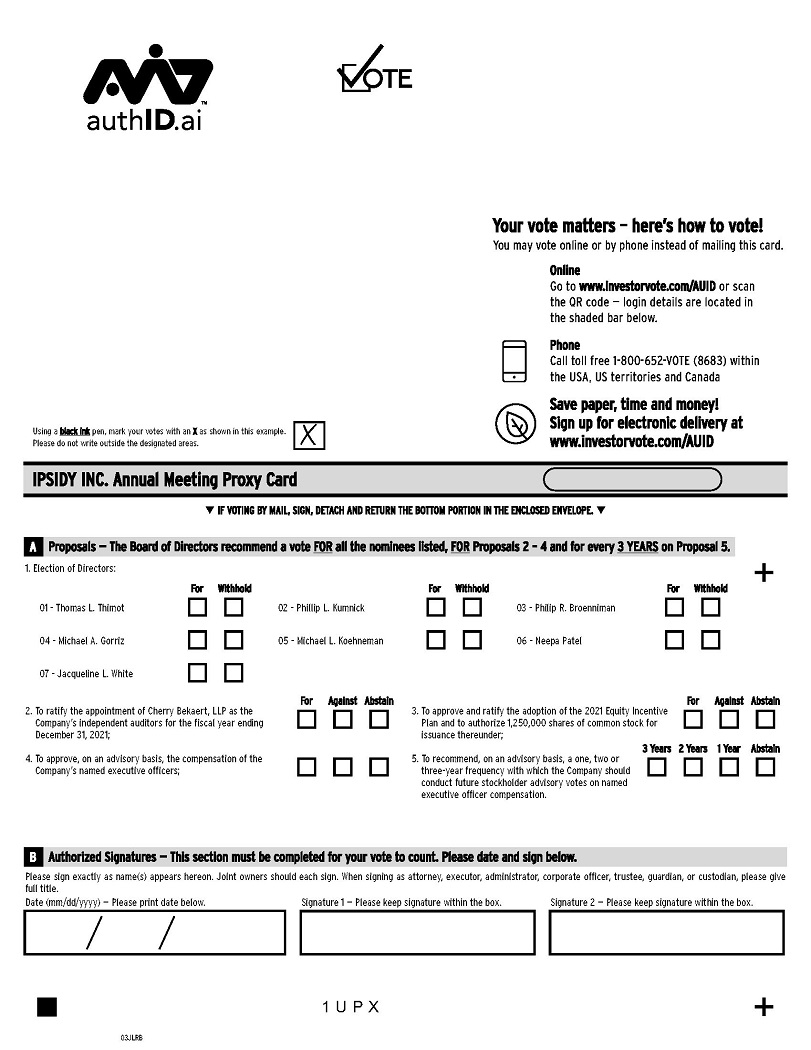

| 1. | To elect the seven director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| 2. | To ratify the appointment of Cherry Bekaert LLP as the Company’s independent auditors for the fiscal year ending December 31, |

3. | To approve an amendment to our certificate of incorporation to effect a reverse stock split at a ratio not less than 1-for-2 and not greater than 1-for-50, with the exact ratio to be set within that range at the discretion of our board of directors before June 30, 2024 without further approval or authorization of our stockholders (the “Reverse Split Proposal”). The board of directors may alternatively elect to abandon such proposed amendment and not effect the reverse stock split authorized by stockholders, in its sole discretion (The form of the proposed amendment to our charter to effect the reverse stock split is attached as Exhibit A to this proxy statement); |

| To approve and ratify the |

| 5. |

| To act on such other matters as may properly come before the meeting or any adjournment thereof. |

BECAUSE OF THE SIGNIFICANCE OF THESE PROPOSALS TO THE COMPANY AND ITS STOCKHOLDERS, IT IS VITAL THAT EVERY STOCKHOLDER VOTE AT THE ANNUAL MEETING IN PERSON OR BY PROXY.

These proposals are fully set forth in the accompanying Proxy Statement which you are urged to read thoroughly. For the reasons set forth in the Proxy Statement, your Board of Directors recommends a vote “FOR” the directors set forth in Proposal 1 and “FOR” Proposals 2, 3 and 4 and that you vote for a three-year interval between the say-on-pay votes.4. A list of all stockholders entitled to vote at the Annual Meeting will be available at the principal office of the Company during usual business hours for examination by any stockholder for any purpose germane to the Annual Meeting for 10 days prior to the date thereof. Stockholders are cordially invited to attend the Annual Meeting.

As we did for the 20202022 Annual Meeting, duein order to the public healthprovide safe and expanded access, improved communication, reduced environmental impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our employees and stockholders,cost savings we are very pleased that for this year’s Annual Meeting we will again be hosting a completely virtual meeting of stockholders, which will be conducted solely online via live webcast. You will be able to attend and participate in the Annual Meeting online and submit your questions prior to and during the meeting by visiting: https://edge.media-server.com/mmc/p/afo9uvqpki9r33k7 at the meeting date and time described in the accompanying proxy statement. There is no physical location for the Annual Meeting.

Having regard to the current pandemic weWe are pleased to embrace the latest technology to provide safe and expanded access, improved communication, reduced environmental impact and cost savings for our stockholders and the Company. If you plan to attend the meeting virtually on the Internet, please follow the registration instructions as outlined in this proxy statement.

However, whether or not you plan to attend the meeting virtually, your shares should be represented and voted. After reading the enclosed Proxy Statement, please sign, date, and return promptly the enclosed Proxy in the accompanying postpaid envelope we have provided for your convenience to ensure that your shares will be represented. Alternatively, please provide your response by telephone or electronically through the Internet by following the instructions set out on the enclosed Proxy card. If you do attend the meeting virtually and wish to vote your shares personally, you may revoke your Proxy.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held December 29, 2021.*, 2023. In addition to the copies you have received, the Proxy Statement and our 20202022 Annual Report on Form 10-K to Stockholders are available at: http://www.edocumentview.com/www.investorvote.com/AUID.

| By Order of the Board of Directors | |

| /s/ | |

| Chairman of the Board of Directors |

WHETHER OR NOT YOU PLAN ON ATTENDING THE MEETING VIRTUALLY, PLEASE VOTE AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

IpsidyauthID Inc.670 Long Beach Boulevard1385 S. Colorado Blvd.,

Long Beach, New York 11561Building A, Suite 322,

Denver, CO 80222

516-274-8700

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of IpsidyauthID Inc. dba auithID.ai (“authID.ai” “Ipsidy”authID” or the “Company”) to be voted at the Annual Meeting of Stockholders (the “Annual Meeting”) which will be held virtually via webcast on December 29, 2021,*, 2023, at 10:00 a.m. Eastern Time, and at any postponements or adjournments thereof. The proxy materials will be furnished to stockholders on or about November 19, 2021.*, 2023.

REVOCABILITY OF PROXY AND SOLICITATION

Any stockholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Annual Meeting and voting the shares of stock virtually in person, or by delivering to the Corporate Secretary of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company, which will bear all costs associated with the mailing of this Proxy Statement and the solicitation of proxies.

RECORD DATE

Stockholders of record at the close of business on November 9, 2021,*, 2023, will be entitled to receive notice of, attend virtually and vote at the Annual Meeting.

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

IpsidyauthID Inc. has furnished these materials to you in connection with the Company’s solicitation of proxies for use at the Annual Meeting of Stockholders to be held on December 29, 2021,*, 2023, at 10:00 a.m. Eastern Standard Time virtually via webcast. These materials describe the proposals on which the Company would like you to vote and also give you information on these proposals so that you can make an informed decision. We are furnishing our proxy materials on or about November 19, 2021*, 2023 to all stockholders of record entitled to vote at the Annual Meeting.

How can I attend the Annual Meeting?

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held.

You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting https://edge.media-server.com/mmc/p/afo9uvqp.ki9r33k7. You also will be able to vote your shares online by going to http://www.investorvote.com/AUID.

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The online meeting will begin promptly at 10.00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

1

How do I register to attend the Annual Meeting virtually on the Internet?

Prior to the commencement of the meeting please go to https://edge.media-server.com/mmc/p/afo9uvqp.ki9r33k7. There you will be asked to register with your name, e-mail address and company details – or if none insert “Individual”.

We encourage stockholders to vote prior to the meeting but if you wish to vote on the day of the meeting you will be able to vote your shares online by going to http://www.investorvote.com/AUID and please follow the instructions in “How to Vote” below and on your Proxy Card.

Why are you holding a virtual meeting instead of a physical meeting?

DueIn order to the public healthprovide safe and expanded access for all stockholders, improved communication, reduced environmental impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our employees and stockholders,cost savings we are very pleased that for this year’s Annual Meeting will again be hosting a completely virtual meeting of stockholders, which will be conducted solely online via live webcast. You will be able to attend and participate in the Annual Meeting online and submit your questions prior to and during the meeting by visiting: https://edge.media-server.com/mmc/p/afo9uvqp atki9r33k7at the meeting date and time described in the accompanying proxy statement. You will be able to vote your shares electronically by going to http://www.investorvote.com/AUID. There is no physical location for the Annual Meeting.

Having regard to the current pandemic we are pleased to embrace the latest technology to provide safe and expanded access, improved communication and cost savings for our stockholders and the Company. If you plan to attend the meeting virtually on the Internet, please follow the registration instructions as outlined in this proxy statement.

Notice of Internet Availability (Notice and Access)

Instead of mailing a printed copy of our proxy materials to each shareholder, we are furnishing proxy materials via the Internet. This reduces both the costs and the environmental impact of sending our proxy materials to our shareholders. If you received a “Notice of Internet Availability,” you will not receive a printed copy of the proxy materials unless you specifically request a printed copy. The Notice of Internet Availability will instruct you how to access and review all of the important information contained in the proxy materials. The Notice of Internet Availability also instructs you how to submit your proxy on the Internet and how to vote by telephone.

If you would like to receive a printed or emailed copy of our proxy materials, you should follow the instructions for requesting such materials included on the documents you received. In addition, if you received paper copies of our proxy materials and wish to receive all future proxy materials, proxy cards and annual reports electronically, please follow the electronic delivery instructions on the documents you received. We encourage shareholders to take advantage of the availability of the proxy materials on the Internet to help reduce the cost and environmental impact of our annual shareholder meetings.

The Notice of Internet Availability is first being sent to shareholders on or about November 19, 2021.*, 2023. Also on or about November 19, 2021,*, 2023, we will first make available to our shareholders this Proxy Statement and the form of proxy relating to the 20212023 Annual Meeting filed with the SEC on November 19, 2021.*, 2023.

What is included in these materials?

These materials include:

| ● | this Proxy Statement for the Annual Meeting; and |

| ● | the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, |

What is the proxy card?

The proxy card enables you to appoint Thomas L. Thimot,Rhoniel A. Daguro, our Chief Executive Officer, and Stuart P. Stoller,Graham Arad, our Chief Financial Officer,General Counsel, as your representatives at the Annual Meeting. By completing and returning a proxy card, or by voting electronically or by telephone you are authorizing these individuals to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card (or submitted electronically or by telephone). This way, your shares will be voted whether or not you attend the Annual Meeting.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting on the cover page of this Proxy Statement, including:

(i) the election of seven persons named herein as nominees for directors of the Company, to hold office subject to the provisions of the bylaws of the Company, until the next annual meeting of stockholders and until their successors are duly elected and qualified;

| (i) | the election of seven persons named herein as nominees for directors of the Company, to hold office subject to the provisions of the bylaws of the Company, until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

(ii) ratification of the appointment of Cherry Bekaert LLP as the Company’s independent auditors for the fiscal year ending December 31, 2021;

(iii) To approve and ratify the adoption of the 2021 Equity Incentive Plan and to authorize 1,250,000 shares of common stock for issuance thereunder;

(iv) To approve, on an advisory basis, the compensation of the Company’s named executive officers;

(v) To recommend, on an advisory basis, a one, two or three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation.

| (ii) | ratification of the appointment of Cherry Bekaert LLP as the Company’s independent auditors for the fiscal year ending December 31, 2023; | |

| (iii) | approval of an amendment to our certificate of incorporation to effect a reverse stock split at a ratio not less than 1-for-2 and not greater than 1-for-50, with the exact ratio to be set within that range at the discretion of our board of directors before June 30, 2024 without further approval or authorization of our stockholders (the “Reverse Split Proposal”). The board of directors may alternatively elect to abandon such proposed amendment and not effect the reverse stock split authorized by stockholders, in its sole discretion (The form of the proposed amendment to our charter to effect the reverse stock split is attached as Exhibit A to this proxy statement); and | |

| (iv) | approval and ratification of the authorization of an additional 2,900,000 shares of common stock for issuance under the 2021 Equity Incentive Plan. |

In addition, management will respond to questions from stockholders.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of one-third of the number of shares of common stock issued and outstanding on the record date will constitute a quorum permitting the meeting to conduct its business. As of the record date, there were 23,206,155* shares of IpsidyauthID common stock issued and outstanding. Thus, the presence of the holders of common stock representing at least 7,735,385* votes will be required to establish a quorum.

2

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Our stockholders may hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially in street name.

How can I get electronic access to the proxy materials?

In addition to the copies of this proxy that you may receive, the Notice of Internet Availability provides you with instructions regarding how to:

| ● | view the Company’s proxy materials for the Annual Meeting on the Internet at |

| ● | request hard copies of the materials; and |

| ● | instruct the Company to send future proxy materials to you electronically by email. |

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s annual meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

Stockholder of Record

If on November 9, 2021,*, 2023, your shares were registered directly in your name with our transfer agent, Computershare Trust Company N.A., you are considered a stockholder of record with respect to those shares, and the Notice of Internet Availability, or Notice of Annual Meeting and Proxy Statement was sent directly to you by the Company. As the stockholder of record, you have the right to direct the voting of your shares via the Internet or by returning the proxy card to us. Whether or not you plan to attend the Annual Meeting, if you do not vote over the Internet, please complete, date, sign and return a proxy card to ensure that your vote is counted.

Beneficial Owner of Shares Held in Street Name

If on November 9, 2021,*, 2023, your shares were held in an account at a brokerage firm, bank, broker-dealer, or other nominee holder, then you are considered the beneficial owner of shares held in “street name,” and the Notice of Annual Meeting & Proxy statement was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from the organization.

How do I vote?

Stockholders of Record.If you are a stockholder of record, you may vote by any of the following methods:

| ● | Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the Notice of Internet Availability or the enclosed Proxy Card. |

| ● | By Telephone.You may vote by calling the toll free number found on the Proxy Card. |

| ● | By Mail.You may vote by completing, signing, dating and returning your Proxy Card in the pre-addressed, postage-paid envelope provided. |

| ● | In Person Virtually. You may attend and vote at the Annual Meeting virtually. When you log on to the Webcast there will be instructions about how to vote. |

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name, you may vote by any of the following methods:

| ● | Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the Notice of Internet Availability or the enclosed Proxy Card. |

| ● | By Telephone.You may vote by proxy by calling the toll-free number found on the vote instruction form. |

| ● | By Mail.You may vote by proxy by filling out the vote instruction form and returning it in the pre-addressed, postage-paid envelope provided. |

| ● | In Person Virtually. If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the organization that holds your shares. When you log on to the Webcast there will be instructions about how to vote. |

How will my vote be counted if I have not yet exchanged my stock certificate for new Common Shares?

On June 14, 2021 we completed a 1-for-30 reverse stock split of our shares of common stock. At that time all stockholders were notified and encouraged to exchange their old paper stock certificates for new shares of common stock in electronic book entry form. If you have not yet exchanged your certificate you will still be able to vote your shares and your votes will be counted on a “as exchanged”, post-split basis. That is to say to say you will get 1 vote for every 30 shares represented by a stock certificate as of November 9, 2021.the record date *, 2023.

We encourage you to exchange your old paper certificate for new electronic shares, using the exchange form provided. If you have lost your certificate or the exchange form, or have any questions about the exchange process, please contact Computershare at 1-877-373-6374+1-800-368-5948 (U.S.) 1-781-575-3100+1-781-575-4223 (Outside the US), via the website http://www.computershare.com/ or by e-mail to web.queries@computershare.com.

What are abstentions and broker non-votes?

While the inspector of elections will treat shares represented by proxies that reflect abstentions or include “broker non-votes” as shares that are present and entitled to vote for purposes of determining the presence of a quorum, abstentions or “broker non-votes” do not constitute a vote “for” or “against” any matter and thus will be disregarded in any calculation of “votes cast.” However, abstentions and “broker non-votes” will have the effect of a negative vote if an item requires the approval of a majority of a quorum or of a specified proportion of all issued and outstanding shares.

Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers (see What happens if I do not give specific voting instructions). As used herein, “uninstructed shares” means shares held by a broker who has not received voting instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter.

What happens if I do not give specific voting instructions?

Stockholders of Record.If you are a stockholder of record and you:

| ● | indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board of Directors, or |

| ● | sign and return a proxy card without giving specific voting instructions, |

then the proxy holders will vote your shares in the manner recommended by the Board of Directors on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters, but not on non-routine matters. Under New York Stock Exchange (“NYSE”) rules, if your shares are held by a member organization, as that term is defined under NYSE rules, responsibility for making a final determination as to whether a specific proposal constitutes a routine or non-routine matter rests with that organization, or third parties acting on its behalf.

What are the Board’s recommendations?

The Board’s recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

| ● | forelection of the seven director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| ● | for ratification of the appointment of Cherry Bekaert LLP as the Company’s independent auditors for the fiscal year ending December 31, | |

●

| for the Reverse Split Proposal; and | |

| ● | for the approval and ratification of the

|

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

4

How are proxy materials delivered to households?

Only one copy of the Company’s Notice of Internet Availability, Annual Report on Form 10-K for the fiscal year ending December 31, 2020 and2022 or this Proxy Statement, as applicable, will be delivered to an address where two or more stockholders reside with the same last name or who otherwise reasonably appear to be members of the same family based on the stockholders’ prior express or implied consent.

We will deliver promptly upon written or oral request a separate copy of the Company’s Notice of Internet Availability, Annual Report on Form 10-K for the fiscal year ending December 31, 2020 and2022 or this Proxy Statement.Statement, as applicable. If you share an address with at least one other stockholder, currently receive one copy of our Annual Report on Form 10-K and Proxy Statement at your residence, and would like to receive a separate copy of our Annual Report on Form 10-K and Proxy Statement for future stockholder meetings of the Company, please specify such request in writing and send such written request to IpsidyauthID Inc.,1624 Market St., 670 Long Beach Boulevard, Long Beach, New York 11561;Ste 226, Unit 51767 Denver, Colorado 80202-1559; Attention: Chief Financial Officer.Corporate Secretary.

Interest of Officers and Directors in matters to be acted upon

Except for the election to our Board of the nominees set forth herein, and the right for Mr. Daguro and Mr. Szoke to receive additional option grants following the authorization of additional shares to be issued under the 2021 Equity Incentive Plan, none of our officers or directors has any interest in any of the matters to be acted upon at the Annual Meeting.

How much stock is owned by 5% stockholders, directors, and executive officers?

The following table sets forth the number of shares known to be beneficially owned by all persons who own at least 5% of Ipsidy’sauthID’s outstanding common stock, the Company’s directors, the Company’s executive officers, and the directors and executive officers as a group as of November 9, 2021,May 5, 2023, unless otherwise noted. Unless otherwise indicated, the stockholders listed in the table have sole voting and investment power with respect to the shares indicated.

| Name | Position | Number of Shares of Common Stock | Percentage of Common Stock | ||||||||

| Officers and Directors | |||||||||||

| Thomas L. Thimot | Director & CEO | 146,426 | (2) | 0.6 | % | ||||||

| Phillip L. Kumnick | Director | 1,308,221 | (3) | 5.4 | % | ||||||

| Philip R. Broenniman | Director | 1,125,935 | (4) | 4.7 | % | ||||||

| Thomas R. Szoke | Chief Solutions Architect | 1,069,444 | (5) | 4.5 | % | ||||||

| Stuart P. Stoller | Chief Financial Officer | 371,529 | (6) | 1.6 | % | ||||||

| Cecil N. Smith III (Tripp) | President and Chief Technology Officer | 44,642 | (7) | 0.2 | % | ||||||

| Jacqueline L. White | Director | 20,833 | (8) | 0.1 | % | ||||||

| Michael L. Koehneman | Director | 22,833 | (8) | 0.1 | % | ||||||

| Sanjay Puri | Director | 20,833 | (8) | 0.1 | % | ||||||

| Michael A. Gorriz | Director | 20,833 | (9) | 0.1 | % | ||||||

| Neepa Patel | Director | 0 | (10) | 0.0 | |||||||

| Total Officers and Directors | 4,151,529 | 17.3 | % | ||||||||

| 5% Stockholders | |||||||||||

| Stephen Garchik | Stockholder | 1,801,212 | (11) | 7.7 | % | ||||||

| Andras Vago | Stockholder | 1,578,942 | (12) | 6.8 | % | ||||||

| Total 5% Stockholders | 3,380,154 | 14.5 | % | ||||||||

| Total Officers, Directors and 5% Stockholders | 7,531,683 | 31.9 | % | ||||||||

| Number of | ||||||||||

| Shares of Common | Percentage of Common | |||||||||

| Name | Position | Stock | Stock (1) | |||||||

| Officers and Directors | ||||||||||

| Rhoniel A. Daguro | Director, CEO | 533,056 | (2) | 2.0 | % | |||||

| Thomas R. Szoke | Director, CTO | 839,998 | (3) | 3.2 | % | |||||

| Michael C. Thompson | Director | 299,000 | (4) | 1.2 | % | |||||

| Michael L. Koehneman | Director | 90,129 | (5) | 0.4 | % | |||||

| Jacqueline L. White | Director | 78,129 | (6) | 0.3 | % | |||||

| Hang Thi Bich (Annie) Pham | CFO | 43,740 | (7) | 0.2 | % | |||||

| Ken Jisser | Director | 33,813 | (8) | 0.1 | % | |||||

| Joseph Trelin | Director | 1,800 | (9) | 0.0 | % | |||||

| Total Officers and Directors | 1,919,665 | 7.4 | % | |||||||

| 5% Stockholders | ||||||||||

| Stephen J. Garchik | Stockholder | 2,619,182 | (10) | 9.9 | % | |||||

| Andras Vago | Stockholder | 1,578,942 | (11) | 6.1 | % | |||||

| Philip R. Broenniman | Stockholder | 1,484,633 | (12) | 5.6 | % | |||||

| Total 5% Stockholders | 5,682,757 | 21.6 | % | |||||||

| Total Officers, Directors and 5% Stockholders | 7,602,423 | 29.0 | % | |||||||

| (1) | Applicable percentage ownership is based on |

| (2) | Comprises a stock option to acquire 2,455,000 shares of common stock at an exercise price of $0.397 per share, which vesting over three years, subject to earlier vesting on upon meeting performance criteria, of which 533,056 will be vested as of July 4, 2023. |

| (3) | Includes |

| (4) | Includes (i) 299,000 shares of common stock, and (ii) a stock option to acquire |

| (5) | Includes (i) 11,772 shares of common stock, (ii) 228 shares of common stock held by Mrs. Koehneman, (iii) a stock option to acquire 62,500 shares of common stock at an exercise price of $7.80 per share, which vest over a three-year period after each Annual Meeting subject to continued service, of which 41,667 are vested, (iv) a stock option to acquire 10,238 shares of common stock at $15.16 per share, and (v) a stock option to acquire 34,966 shares of common stock at $3.03 per share that vest on a monthly basis over 12 months from September 20, 2022 |

| (6) | Includes (i) a stock option to acquire 62,500 shares of common stock at an exercise price of $7.80 per share, which vest over a three-year period after each Annual Meeting subject to continued service, of which 41,667 are vested, (ii) a stock option to acquire 10,238 shares of common stock at $15.16 per share, and (iii) a stock option to acquire 34,966 shares of common stock at $3.03 per share that vest on a monthly basis over 12 months from September 20, 2022. |

| (7) | Includes (i) a stock option to acquire 350,000 shares of common stock at an exercise price of $2.41 per share vesting over a four-year period and subject to certain performance vesting criteria, of which |

| Includes (i) |

| (9) | Includes (i) 1,800 shares of |

| (10) | Includes (i) 2,040,754 shares of common stock held by Mr. Garchik personally, (ii) 78,175 shares of common stock held by Marla Garchik, Mr. Garchik’s wife, (iii) 166,667 shares of common stock held by the Garchik 2019 Irrevocable Trust (“2019 Trust”) of which Mr. Garchik is a trustee and beneficiary, (iv) 11,667 shares of common stock held by Garchik Universal Limited Partnership, which Mr. Garchik jointly controls with his sister, (v) 89,306 shares of common stock held by the Marla Garchik 2020 Irrevocable Trust (the “2020 Trust”) of which Mr. Garchik is a beneficiary, (vi) a common stock |

| Includes 106,667 shares held by Multipolaris Corporation, 832,275 shares held by Interpolaris Pte. Ltd. and 640,000 held by MP Informatikai Kft. Mr. Vago is an officer and principal of each of these entities, and he may be deemed the beneficial owner or the shares held by such entities. |

| (12) | Includes (i) |

6

INFORMATION ABOUT THE BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

The Board of Directors oversees our business and affairs and monitors the performance of management. In accordance with corporate governance principles, the Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chief Executive Officer and other key executives, visits to the Company’s facilities, by reading the reports and other materials that we send them and by participating in Board and committee meetings. Each director’s term will continue until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. Except as set forth in this Proxy Statement, none of our directors held directorships in other reporting companies or registered investment companies at any time during the past five years. Our Board currently consists of eight persons, seven of whom have been nominated by the Company to stand for re-election. The Board and its Governance Committee believe the Board nominees possess the skills and experience to effectively monitor performance, provide oversight, and advise management on the Company’s long-term strategy. Below is the biographical information pertaining to our executive officers and directors.

| Name | Age | Position (s) and Offices Held | ||||

| 48 | Director and Chief Executive Officer | |||||

| Joseph Trelin (1)(3) | 62 | Chairman of the Board of Directors | ||||

| Hang Thi Bich Pham (Annie) | 47 | Chief Financial Officer | ||||

| Ken Jisser | ||||||

| Director | ||||||

| Michael L. Koehneman* (1)(2) | 62 | Director | ||||

| Thomas R. Szoke | 58 | Director and Chief Technology Officer | ||||

| Michael C. Thompson (2)(3) | 62 | Director | ||||

| Jacqueline L. White* (1)(3) | 59 | Director | ||||

| * | denotes Committee Chair |

| (1) | Audit Committee |

| (2) | Governance Committee |

| (3) | Compensation Committee |

Thomas L. ThimotRhoniel A. Daguro

Mr. Thimot was appointed as Chief Executive Officer and as a Director of our company on June 14, 2021. From 2018 through November 2020, Mr. Thimot served as Chief Executive Officer and Director of Socure, Inc., a leading provider of identity verification and fraud risk solutions. Prior to joining Socure, from September 2015 to October, 2018, Mr. Thimot served as CEO and Director of Clarity Insights a privately held provider of data science consulting acquired by Accenture plc. where he was responsible for all operational aspects of the business. Prior to Clarity Insights, Mr. Thimot served as the Vice President of Cognizant Technology Solutions (Nasdaq: CTSH), a consulting firm and emerging business accelerator where he was responsible for all emerging services related to social, mobile, data analytics and cloud. Prior to 2015, Mr. Thimot held various roles and founded various businesses including his own consulting business, CaseCentral (an eDiscovery cloud-based software service now part of Oracle), Kazeon (a data and analytics software provider now part of Dell), GoRemote, Netegrity and Enigma. Mr. Thimot started his career with Oracle, Price Waterhouse and Accenture and received his BS Mechanical Engineering from Marquette University.

Phillip L. Kumnick

Mr. Kumnick was appointed a director of the Company in December 2019 and served as the Chief Executive Officer from May 2020-June 2021. On October 30, 2020 he also became the Chairman of the Board of Directors of the Company. From 2010 to 2018, Mr. Kumnick was Senior Vice President Global Acquirer Processing at Visa, Inc., and was the executive in charge of leading and growing Visa’s acquirer and merchant processing services and omni-channel solutions on a global basis. Mr. Kumnick was also a key contributor to the design of the Secure Remote Commerce (SRC) standard now being rolled out by the card brands, which aims to provide a simple and secure card payment experience. SRC uses tokenization to protect consumers’ sensitive data and intelligent identity authentication to help distinguish legitimate cardholders from fraudsters. Mr. Kumnick was the product owner and developer of Visa’s critical entry into encryption and tokenization products and services for their acquiring partners for transactions at the physical point of sale. Prior to joining Visa, Mr. Kumnick was the leader of the Cards & Payments practice of Cap Gemini Consulting from October 2009 through June 2010. Prior to Cap Gemini Consulting. Mr. Kumnick was a Senior Vice President at TSYS Acquiring Solutions from 2001 to 2009, with responsibility for leading the Product Management team and expanding the Company’s portfolio of merchant and acquirer products. He was also a leader of key M&A activities, including business development and strategic investment in Europe, Latin America and Asia, and helped expand TSYS’ client footprint to over 70 countries. Mr. Kumnick started his payments career at MasterCard International where he worked from 1988 to 2000, in various capacities, rising to Vice President & Chief Settlement Officer – Global Settlement Operations. In that role he was responsible for the 7 x 24 x 365 mission critical clearing and payment operations of a $3.0 billion per day global EFT and treasury operation. Mr. Kumnick was a strategic subject matter expert and key contributor to the evolution of MasterCard’s global processing functions. Mr. Kumnick has an MBA- Finance and a BS Finance from St. Louis University.

Cecil N. Smith III (Tripp)

Mr. Smith was appointed as President and Chief Technology Officer on June 14, 2021. Mr. Smith is a technologist and thought leader specializing in data, analytics and AI. His experience spans entrepreneurial ventures to Fortune 100 enterprises, centered around strategy, product engineering, sales, and building high performance data science and engineering teams. In 2011, Mr. Smith joined Clarity Insights, a RLH Equity and Salesforce Ventures-backed data consultancy with deep data science, artificial intelligence and machine learning expertise. There he worked with hyper scale technology companies ultimately rising to Chief Technology Officer. Mr. Smith led Clarity Insights to a $100MM+ ARR and an acquisition by Accenture AI in 2020. In 2020, Mr. Smith joined Socure Inc., a leading provider of identity verification and fraud risk solutions, as an advisor supporting Product, Technology, Marketing, and Sales functions. Mr. Smith previously held technical leadership roles at Hewlett Packard and the Advisory Board Company and is a graduate of the University of North Carolina at Chapel Hill.

Stuart Stoller

On January 31, 2017, Stuart Stoller was appointed Chief Financial Officer of the Company. Prior to joining the Company Mr. Stoller served as Chief Financial Officer and Board Member for TestAmerica Environmental Services LLC from May 2016 to October 2017. From December 2013 to April 2016, he was the Chief Financial Officer of Associated Food Stores. Mr. Stoller served as Chief Financial and Administrative Officer for Sleep Innovations from August 2009 to October 2013. Prior to joining Sleep Innovations, Mr. Stoller for 29 years served various roles with the New York Times Company including Senior Vice President for Process Reengineering and Corporate Controller and various capacities at Macy’s which included the role of Senior Vice President and Corporate Controller. He also was the controller of Coopers & Lybrand LLP. He is a Certified Public Accountant.

Thomas R. Szoke

Thomas R. Szoke serves as Chief Solutions Architect of the Company. Mr. Szoke is a co-founder of Innovation in Motion (“IIM”) a predecessor of Ipsidy and has over 25 years of product engineering, global sales and operations management experience. He has held several executive positions in the Company and has successfully led it from its inception to its listing on the OTC Market as well as expanding its market presence and product portfolio through strategic acquisitions in the United States, South America and Africa. Mr. Szoke pioneered the concept and development of certain product lines as well as its Multi-Factor Out-of-Band Identity and Transaction Authentication Platform.

Prior to founding IIM, Mr. Szoke spent 23 years with Motorola, Inc. holding various management positions in field and product engineering, systems integration, program management and sales. He spent the last 10 years of his career at Motorola in the Biometrics Industry as Director of Integration and Project Management and then Director of Global Business Development for Civil Biometrics. From 2008-2011, Mr. Szoke was President of Thomas Szoke LLC, a technology consulting company focused on identity management and secure credentialing solutions. Mr. Szoke holds a degree in Electrical Engineering and Applied Mathematics from the University of Akron, in Ohio and is fluent in Hungarian.

10

Philip R. Broenniman

Philip Broenniman was appointed a director of the Company in March 2020 and served as the President and Chief Operating Officer from May 2020-June 2021. Since 2011, Mr. Broenniman has been Managing Partner and Portfolio Manager for Varana Capital, LLC (“VCLLC”), an investment firm he co-founded in 2011. As part of the VCLLC investment strategy of cooperative engagement, Mr. Broenniman sits on or advises the Board of multiple public/private companies, working with each on strategic planning, operational dynamics, and balance sheet needs/restructuring. Prior to co-founding Varana Capital in 2011, he held the positions of Principal and Portfolio Manager at Visium Asset Management, LP; Managing Partner and Portfolio Manager at Cadence Investment Partners, LLC; and Investment Analyst with the Bass Family Office in Fort Worth, TX. He began his career at Salomon Brothers Inc. trading fixed-income futures and options. Mr. Broenniman earned a BS in Computer Science from Duke University in 1987, an MBA from the Darden School at the University of Virginia in 1993 and the Chartered Financial Analyst (CFA) designation in 2000.

Michael A. Gorriz

Dr. GorrizDaguro joined our company as a director on JuneMarch 9 2021. Dr. Gorriz2023 and was appointed CEO on March 23, 2023. He has beenover 20 years of sales, marketing, technology, and venture capital experience. He has built multiple profitable software and professional services firms. Most recently, from 2018 to 2022, he served as the Chief InformationRevenue Officer and a member of the management team of Standard Chartered Bank, Singapore since 2015. He is also Non-Executive Director of the Standard Charted Bank Hong Kong Board and the mox HK Board.Socure Inc. Prior to that, heMr. Daguro held various executive sales positions with Persistent Systems, Hortonworks, and Oracle.

Joseph Trelin

Mr. Trelin joined our company as a Director on April 18, 2022 and became Chairman of the Board on March 16, 2023. Mr. Trelin, is a senior, creative business and product leader, technologist and entrepreneur. Since June 2021, Mr. Trelin has served in a consultant capacity advising start-ups to mid-size companies on operations, product strategy and growth. From January 2016 to July 2019, Mr. Trelin served as the Chief Platform Officer of Clear Secure Inc. Mr. Trelin served as the VP Product, Digital Products at NBCUniversal, Inc. from January 2015 through January 2016 and in various roles including as Product Management & Technology Business Leader and General Manager for Amazon.com, Inc. from January 2009 to January 2015. Mr. Trelin also previously served as the Vice President, Product Development and IT for Standard and Poor’s. Mr. Trelin received a Masters Equivalent in Computer Science from Hofstra University and a BA in Sociology from the State University of New York Albany.

Annie Pham

Mrs. Hang Thi Bich Pham (“Annie”) serves as Chief Financial Officer of the Company since June 21, 2022. Mrs. Pham has served in senior finance leadership roles in the technology sector, most recently at SonicWall, Inc, where she served as Chief InformationAccounting Officer from 2017 to the present. From 2014 to 2017, Mrs. Pham served as Vice President of Finance at Daimler AGApplied Micro Circuits Corporation (acquired by MACOM Technology Solutions Holding and from 2007. Dr. Gorriz attended2008 to 2014 as Director, Assistant Corporate Controller at Broadcom (formerly Avago), where she scaled Avago’s global financial function to meet the requirements of a publicly traded and high-growth company with revenues growing from $1+billion to $2+billion over a three-year period. Mrs. Pham earned her MBA at the University of Konstanz,Sydney, Australia. She is a Licensed Certified Public Accountant (active) in the Universitystate of Freiburg and obtained his Doctorate in Engineering from the University of Stuttgart.California.

Ken Jisser

Mr. Jisser joined authID as a Director on March 9, 2023. He is the Founder & CEO of The Pipeline Group, Inc., a technology-enabled services company that aims to deliver business results for companies looking to build predictable and profitable pipeline. Mr. Jisser founded the company in his garage in 2017, and it reached #415 among the fastest growing private companies in America, according to Inc. Magazine rankings published in 2021. Prior to that, Mr. Jisser served as GTM Advisor at Druva Inc., where he rebuilt the global inside sales team.

Michael L. Koehneman

Mr. Koehneman joined our company as a Director on June 9, 2021. Mr. Koehneman previously held various positions at Pricewaterhouse Coopers, a global accounting firm, through 2020, including the Global Advisory Chief Operating Officer and Human Capital Leader from 2016 through 2019, the U.S. Advisory Operations Leader from 2005 through 2016 responsible for the oversight of Advisory services for PwC, including business unit performance, finance, investments, human resources, acquisitions, and administration, and the Lead Engagement Partner for Financial Statement Audits and Internal Control and Security Reviews from 1993 through 2004 for several public and private company audits. Since 2020 he has also served as a director and member of the Audit Committee of Aspen Group, Inc.

Neepa PatelThomas R. Szoke

Ms. Patel joined our companyMr. Thomas Szoke is a co-founder of AuthID and has over 35 years of executive management, solutions engineering, and operations management experience in Government Security, Identity Access Management and SaaS solutions industries. He rejoined the Company as a Director on November 15,March 9, 2023 and was appointed as Chief Technology Officer on April 12, 2023. Mr. Szoke previously served as a Director and the Company’s Chief Solutions Architect and has held several other executive positions since its inception, from 2013 through 2021. Neepa Patel isHe has also expanded the FounderCompany’s market presence and CEOproduct portfolio through technological innovation and global strategic partnerships. Mr. Szoke has been issued several US and international patents focused on identity solutions and has pioneered the concept and development of Themis - a collaborative tech platform to help fintechs, banks and crypto companies create a strong governance, risk and compliance framework. Neepa has 15+ years of experience in various regulatory and compliance positions across the public and private sector. Prior to founding Themis in March 2020, she was the Head of Compliance for an enterprise blockchain company, R3 from 2016 through December 2019. Before that she had several risk and compliance positions at Deutsche Bank from 2014 to 2016 and at Morgan Stanley between 2011 and 2014. At Morgan Stanley, she helped develop a compliance frameworkdifferent product lines for the newly formed banking entities, Morgan Stanley BankCompany including its Multi-Factor Out-of-Band Identity and Morgan Stanley Private Bank post crisis. Neepa began her career as a Bank Examiner atTransaction Authentication Platform. Since 2021, he has been an independent consultant for the Office of the Comptroller of the Currency (OCC), where she worked from 2005 to 2011. Neepa attended Georgia Tech.Company and others.

Michael C. Thompson

Sanjay Puri

Mr. PuriThompson joined our companythe Company as a Director on JuneMarch 9, 2021.2023. He has over 38 years of domestic and international experience in publicly traded and private equity backed consumer and commercial businesses. Since 2022, Mr. Puri is currentlyThompson has been a managing Directorpartner at Progress Partners, Inc.Hemingway Capital, an operationally focused private equity firm. Previously, he served as Chief Executive Officer for companies in the bedding (Corsicana Mattress from 2018 to 2022), polyurethane foam and pet products industries and was an operating executive for two leading middle-market private equity firms. Mr. Puri is an established entrepreneur whoThompson has spent the last two decades startingalso held executive positions with Rubbermaid Commercial Products, Merillat Industries, a division of Masco Corporation, and advising successful, high-growth businesses across fintech, entertainment/media, software, ecommerceBlack+Decker, and subscription industries. An expert in payment processors, identity management, and exhibitor relationships, Mr. Puri has raised more than $700 million in capital overbegan his career and in his most recent role as Founder and Managing Director of Progress Partners, Mr. Puri is focused on identifying new capital raising opportunities for companies.with Sunbeam Appliance Company.

Jacqueline L. White

Ms. White joined our company as a Director on June 9, 2021. Ms. White has been a leader in enterprise technology software and IT consulting for the past 25 years. Ms. White has held global positions at SAP, Oracle, and Accenture, always leading diverse, high performing organizations around the world. After leading the Banking & Capital Markets line of business of DXC Technology Co. (NYSE: DXC) as Senior Vice President and Practice Lead from September 2019 to January 2021, Ms. White recently joined in January 2021 the Executive Management Team of Temenos AG (Six: TEMN), a company specializing in enterprise software for banks and financial services, as the President of the Americas Region. From January 2018 through September 2019, Ms. White served as the Chief Revenue Officer of Saltstack, a VM Ware Company, and from January 2015 through January 2018 as Global Senior Vice President Global FSI Consulting for SAP (NYSE: SAP). Prior to joining SAP, Ms. White held various positions with Accenture Services Pvt. Ltd., Oracle, BearingPoint and Novell. Ms. White was named by Utah Business Magazine as “Top Executives to Watch” in July 2020. Ms. White received a BA in Comparative Literature from Brigham Young University and a Leadership Certificate from Boston University.

Director Independence

The Company is listed on the Nasdaq Capital Market and therefore the Company is complying with the Nasdaq Listing standards applicable to director independence. Pursuant to Rule 4200 of The Nasdaq Stock Market one of the definitions of an independent director is a person other than an executive officer or employee of a company. The Nasdaq rules require companies to maintain a Board a majority of the members of which are independent directors. Additionally, compensation committee members must not have a relationship with the Company that is material to the director’s ability to be independent from management in connection with the duties of a compensation committee member. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or be an affiliated person of the listed company or any of its subsidiaries.

Our Board of Directors has undertaken a review of the independence of each Director and considered whether each director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our board of directors determined that all of our directors, other than Mr. Thimot, our Chief Executive Officer, Mr. Kumnick our Chairman and Mr. Broenniman are “independent directors” as defined under the applicable listing requirements and rules of Nasdaq. In making these determinations, our board of directors reviewed and discussed information provided by the directors and by us with regard to each director’s business and personal activities and relationships as they may relate to us and our management, including the beneficial ownership of our common stock by each non-employee director.

Committees and Terms

Board & Committees

Board meetings during calendar year ended 20202022

During 2020,2022, the Board of Directors held thirteenseven meetings as well as committee meetings, as outlined below. Each director then in office attended all of the meetings of the Board and all of the meetings held by all committees on which such director served.served, apart from one meeting which one director was not able to attend. The Board also approved certain actions by unanimous written consent.

Committees established by the Board

The Board of Directors has standing Audit, Compensation, and Governance Committees. Information concerning the function of each Board committee follows.

Audit Committee

The Audit Committee is responsible for overseeing management’s implementation of effective internal accounting and financial controls, supervising matters relating to audit functions, reviewing and setting internal policies and procedures regarding audits, accounting and other financial controls, reviewing the results of our audit performed by the independent public accountants, and evaluating and selecting the independent public accountants. The Audit Committee has adopted an Audit Committee Charter which is posted on ourthe Corporate Governance landing page under the tab labeled “Investors”“Board Committees” on our Investor Relations website at http:https://www.authid.ai.investors.authid.ai. The Board has designated Mr. Koehnemanthe Chair of the Committee as the “audit committee financial expert” as defined by the SEC. During 2020,2022, the Audit Committee held five conference callsix meetings. The Committee also approved certain actions by unanimous written consent.

Compensation Committee

The Compensation Committee determines matters pertaining to the compensation of our named executive officers and administers our stock option and incentive compensation plans, or Equity Incentive Plans.plans. The Compensation Committee has adopted a Compensation Committee Charter which is posted on our which is posted on the Corporate Governance landing page under the tab labeled “Investors”“Board Committees” on our Investor Relations website at http:https://www.authid.ai.investors.authid.ai. During 2020,2022, the Compensation Committee held twothree meetings through conference calls.and also approved certain actions by unanimous written consent.

Governance Committee

The Governance Committee is responsible for considering potential Board members, nominating Directors for election to the Board, implementing the Company’s corporate governance policies, recommending compensation for the Board and for all other purposes outlined in the Governance Committee Charter, which is posted on ourthe Corporate Governance landing page under the tab labeled “Investors”“Board Committees” on our Investor Relations website at http:https://www. authid.ai.investors.authid.ai. During 2020,2022, the Governance Committee did not hold any meetings.held two meetings also approved certain actions by unanimous written consent.

Nomination of Directors

As provided in its charter, the Governance Committee is responsible for identifying individuals qualified to become directors. The Governance Committee seeks to identify director candidates based on input provided by a number of sources including (1) the Governance Committee members, (2) our other directors, (3) our stockholders, (4) our Chief Executive Officer or Chair of the Board, and (5) third parties such as service providers. In evaluating potential candidates for director, the Governance Committee considers the entirety of each candidate’s credentials.

Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of the Board of Directors. However, at a minimum, candidates for director must possess:

| ● | high personal and professional ethics and integrity; |

| ● | the ability to exercise sound judgment; |

| ● | the ability to make independent analytical inquiries; |

| ● | a willingness and ability to devote adequate time and resources to diligently perform Board and committee duties; and |

| ● | the appropriate and relevant business experience and acumen. |

Board Diversity

The Board believes that a diverse membership having a variety of skills, styles, experience and competencies is an important feature of a well-functioning board. Accordingly, the Board believes that diversity of viewpoints, backgrounds and experience (inclusive of gender, age, race and ethnicity) should be a consideration in Board succession planning and recruiting. In recent years, the Governance Committee has taken this priority to heart in its nominations process, and the diversity of the Board has grown significantly. One of the seven current members of the Board is female and two self identify as an underrepresented minority satisfying The Nasdaq Stock Market, LLC Listing Rules’ (the “NASDAQ Listing Rules”) objective for listed companies to have at least two diverse directors, including one who self-identifies as female and one who self-identifies as either an underrepresented minority or LGBTQ+. The chart below provides certain information regarding the diversity of the Board as of May 5, 2023.

| Board Diversity Matrix as of May 5, 2023 | ||||||||||||

| Total Number of Directors | 8 | |||||||||||

| Female | Male | Non-Binary | ||||||||||

| Part I: Gender Identity | ||||||||||||

| Directors | 1 | 6 | - | |||||||||

| Part II: Demographic Background | ||||||||||||

| African American or Black | - | - | - | |||||||||

| Alaskan Native or Native American | - | - | - | |||||||||

| Asian | - | 1 | - | |||||||||

| Hispanic or Latinx | - | 1 | - | |||||||||

| Native Hawaiian or Pacific Islander | - | - | - | |||||||||

| White | 1 | 5 | - | |||||||||

| Two or More Races or Ethnicities | - | - | - | |||||||||

| LGBTQ+ | 0 | 0 | 0 | |||||||||

Board Leadership Structure and Role in Risk Oversight

The Board recognizes that the leadership structure and combination or separation of the CEO and Chairman roles is driven by the needs of the Company at any point in time. As a result, no policy exists requiring combination or separation of leadership roles and our governing documents do not mandate a particular structure. This has allowed the Board the flexibility to establish the most appropriate structure for the Company at any given time.

In June 2021, the Board elected to separate the role of Chief Executive Officer and Chairman of the Board of Directors. Currently, Mr. Daguro serves as the Chief Executive Officer and Mr. Trelin serves as the Chairman of the Board. The Board believes that the separation of the Chairman of the Board and CEO roles currently provides the most efficient and effective leadership model for the Company as it encourages free and open dialogue regarding competing views and provides for strong checks and balances. Specifically, the balance of powers among our CEO and the Chairman of the Board facilitates the active participation of all directors and enables the Board to provide more effective oversight of management. In addition, the Board believes that this separation enables our CEO to focus on the management and operations of our business and the development and implementation of strategic initiatives, while our Chairman of the Board leads the Board in the performance of its responsibilities.

The Board, led by the Audit Committee, is actively involved in overseeing our risk management processes. The Board focuses on our general risk management strategy and ensures that appropriate risk mitigation strategies are implemented by management. Further, operational and strategic presentations by management to the Board at Board meetings include consideration of the challenges and risks of our businesses, and the Board and management actively engage in discussion on these topics. In addition, each of the Board’s committees considers risk within its area of responsibility.

Legal Proceedings

There are currently no legal proceedings, and during the past 10 years there have been no legal proceedings, that are material to the evaluation of the ability or integrity of any of our directors.

Family Relationships

There are no family relationships among our directors and executive officers. There is no arrangement or understanding between or among our executive officers and directors pursuant to which any director or officer was or is to be selected as a director or officer.

Involvement in Certain Legal Proceedings

To our knowledge, during the last ten years, none of our directors and executive officers has:

| ● | Had a bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time. |

| ● | Been convicted in a criminal proceeding or been subject to a pending criminal proceeding, excluding traffic violations and other minor offenses. |

| ● | Been subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities. |

| ● | Been found by a court of competent jurisdiction (in a civil action), the SEC, or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated. |

| ● | Been the subject to, or a party to, any sanction or order, not subsequently reverse, suspended or vacated, of any self-regulatory organization, any registered entity, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

To our knowledge, none of our directors and executive officers has at any time been subject to any proceedings:

13

| ● | that were initiated by any regulatory, civil or criminal agency | |

| ● | in which claims alleging fraud were asserted and seeking damages in excess of $100,000 |

Code of Ethics

We have adopted a Code of Business Conduct and Ethics Policy (the “Code of Ethics”) that applies to all directors and officers.officers, which is posted on the Corporate Governance page under the tab labeled “Board Committees” on our Investor Relations website at https://investors.authid.ai. The Code of Ethics describes the legal, ethical and regulatory standards that must be followed by the directors and officers of the Company and sets forth high standards of business conduct applicable to each director and officer. As adopted, the Code of Ethics sets forth written standards that are designed to deter wrongdoing and to promote, among other things:

| ● | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| ● | compliance with applicable governmental laws, rules and regulations; |

| ● | the prompt internal reporting of violations of the Code of Ethics to the appropriate person or persons identified in the code; and |

| ● | accountability for adherence to the Code of Ethics. |

Stockholder CommunicationsSection 16(a) Beneficial Ownership Reporting Compliance

Stockholders requesting communication with directors can do so by writing to Ipsidy Inc., c/o SVP MarCom and Investor Relations (“SVP IR”), 670 Long Beach Boulevard, Long Beach, New York 11561 or emailing to investor-relations@authid.ai. At this time, we do not screen communications received and would forward any requests directly to the named director. If no director was named in a general inquiry, the SVP IR would contact either the ChairSection 16(a) of the BoardSecurities Exchange Act of Directors or1934, as amended, requires our directors and executive officers and persons who own more than 10% of the chairpersonissued and outstanding shares of our common stock to file reports of initial ownership of common stock and other equity securities and subsequent changes in that ownership with the SEC. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on a particular committee, if any, as appropriate. We do not providereview of the physical address, email address, or phone numberscopies of Directorssuch reports furnished to outside parties without a Director’s permission.us and written representations that no other reports were required, during the fiscal year ended December 31, 2022 all Section 16(a) filing requirements applicable to our officers, directors and greater than 10% beneficial owners were complied with, except that one filing was inadvertently made late by Mr. Broenniman and Mr. Gorriz.

Compensation of Directors

The following table sets forth the compensation of non-management Directors earned during 2020.the year ended December 31, 2022.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards (S) | Option Awards (S)(1) | Other Compensation ($) | Total ($) | |||||||||||||||

| Herb Selzer | - | - | 87,000 | - | 87,000 | |||||||||||||||

| Theodore Stern | - | - | 87,000 | - | 87,000 | |||||||||||||||

| Phillip Kumnick | - | - | 36,250 | - | 36,250 | |||||||||||||||

| Philip Beck | - | - | 36,250 | - | 36,250 | |||||||||||||||

| Philip Broenniman | 21,750 | 21,750 | ||||||||||||||||||

| Ricky Solomon | - | - | 833 | - | 833 | |||||||||||||||

The non-management Directors earned $72,000 per annum through May 2021 for Board membership, inclusive of all Board meeting and committee meeting attendance fees in the form of a stock grant and they earn an additional annual retainer for service on each committee of $5,000. The Company has recorded the expense associated with Board Compensation but has not granted or paid fees since October 2019. Total board compensation recorded in 2020 was approximately $269,000 of which $47,000 was the retainer for Board Committees and the balance of $222,000 was the retainer for service on the Board. Mr. Stern and Mr. Selzer each earned $15,000, Mr. Kumnick and Mr. Beck each earned $6,250, Mr. Broenniman earned $3,750 and Mr. Solomon $833.

The non-management Directors in 2020 were as follows:

The non-management Directors were compensated for their service in 2020 through the issuance of stock compensation following the Annual Meeting held in March 2021 by the issuance of a total of 93,470 Stock Options at an exercise price of $7.20, which were vested upon May 5, 2021 the date of grant.

During 2019, the Company recorded expense of $40,000 for the annual retainer for service on Board. The amounts recorded for Mr. Selzer, Mr. Stern and Mr. Solomon for the annual retainer for service on Board committees was $15,000, $15,000, and $10,000 in addition to their stock compensation of $72,000 each per annum. Total board compensation recorded in 2019 was approximately $256,000.

On his appointment Mr. Kumnick received a grant of an option to purchase 100,000 shares of common stock vesting in equal parts over three years, or earlier in the event of a change of control of the Company (as defined in the option grant). In March 2020, the Company entered into a restricted stock purchase agreement with Phillip Kumnick, providing Mr. Kumnick with the right to acquire 50,000 shares of common stock at par value subject to the Vesting Criteria (as defined in the stock purchase agreement). On his appointment, the Company entered into a restricted stock purchase agreement with Philip Broenniman, providing Mr. Broenniman with the right to acquire 50,000 shares of common stock at $0.003 per share subject to the Vesting Criteria. The performance element of the Vesting Criteria has been satisfied and the shares will vest on or before December 31, 2021, subject to continued service under certain conditions.

| Fees Paid in Cash ($) | Stock Awards ($) | Total ($) | ||||||||||

| Philip Kumnick | 15,500 | 659,000 | 674,500 | |||||||||

| Chairman of the Board, Former CEO and President (1)(2) | ||||||||||||

| Philip Broenniman | 11,000 | 820,000 | 831,000 | |||||||||

| Board Member, Former President (1)(2) | ||||||||||||

| Michael Gorriz | 15,000 | 234,000 | 249,000 | |||||||||

| Board Member (2) | ||||||||||||

| Michael Koehneman | 16,000 | 234,000 | 250,000 | |||||||||

| Board Member | ||||||||||||

| Neepa Patel | 16,000 | 129,000 | 145,000 | |||||||||

| Board Member (2) | ||||||||||||

| Joseph Trelin | 14,000 | 113,000 | 127,000 | |||||||||

| Board Member | ||||||||||||

| Jacqueline White | 17,500 | 234,000 | 251,500 | |||||||||

| Board Member | ||||||||||||

In May 2021, the Board resolved to adopt a new compensation policy for non-management directors, comprising the following:

(a) On appointment as a new director, each director shall receive a grant of options having a Black Scholes value of $270,000, subject to three-year

| ● | On appointment as a new director, each director shall receive a grant of options having a Black Scholes value of $270,000, subject to three- year vesting, one-third earned after each Annual Meeting. If the director does not serve for at least three years, then they will lose a proportionate part of the award. |

| ● | After each Annual Meeting, commencing with the first Annual Meeting at which a director is re-elected to the Board, each director would receive a grant of options having a Black Scholes value of $90,000, subject to one year vesting (one twelfth earned each month). If the director does not serve the full year, then they will lose a proportionate part of the award. |

In May 2022, the Board approved that the Compensation Plan be amended as follows:

| ● | For attendance at each Board or Committee meeting of the Company, each director, who is not a committee chair, shall receive the sum of $2,000. |

(b) After each Annual Meeting, commencing with the first Annual Meeting at which a director is re-elected to the Board, each director would receive a grant of options having a Black Scholes value of $90,000, subject to one year vesting (one twelfth earned each month). If the director does not serve the full year, then they will lose a proportionate part of the award.

| ● | For attendance at each Board or Committee meeting of the Company, each director, who is a committee chair shall receive the sum of $2,500. |

| ● | For attendance at each Board or Committee meeting of the Company, which lasts more than 2 hours, in lieu of the above sums, each director shall receive the sum of $1,000 per hour duration of such meeting. |

| ● | When Board and Committee meetings are held on the same day, the meetings shall be treated as a single meeting for the purpose of determining compensation. |

| ● | Payment shall be made quarterly in arrear in the month following completion of each fiscal quarter commencing July 2022 for the 2nd quarter. |

| (1) | Mr. Philip Kumnick served as CEO and President and Mr. Phillip Broenniman served as President of the Company through the middle of June 2021. The Company granted Mr. Kumnick stock options to acquire 583,333 shares of common stock that vest upon the achievement of certain market capitalization thresholds or performance conditions. In November 2021, Mr. Kumnick agreed to cancel 300,000 of these stock options in consideration of removing certain service conditions. The Company granted Mr. Broenniman stock options to acquire 583,333 shares of common stock that vest upon the achievement of certain market capitalization thresholds or performance conditions. In November 2021, Mr. Broenniman agreed to cancel 200,000 of these stock options in consideration of removing certain service conditions. On his appointment to the Board of Directors, Mr. Kumnick received a grant of an option to purchase 100,000 shares of common stock vesting in equal parts over three years, or earlier in the event of a change of control of the Company (as defined in the option grant). In March 2020, the Company entered into a restricted stock purchase agreement with Phillip Kumnick, providing Mr. Kumnick with the right to acquire 50,000 shares of common stock at par value subject to the Vesting Criteria (as defined in the stock purchase agreement). On Philip Broenniman’s appointment, the Company entered into a restricted stock purchase agreement with him, providing Mr. Broenniman with the right to acquire 50,000 shares of common stock at par value subject to the Vesting Criteria. The Vesting Criteria were met in 2021 and as a result the Company recorded a restricted stock expense of $127,500 each for Mr. Phillip Kumnick and Mr. Philip Broenniman. |

| (2) | Resigned March 9, 2023 |

EXECUTIVE COMPENSATION

Executive Compensation

The below table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to (i) all individuals serving as the Company’s principal executive officers or acting in a similar capacity during the last two completed fiscal years, regardless of compensation level, and (ii) the Company’s two most highly compensated executive officers other than the principal executive officers serving at the end of the last two completed fiscal years (collectively, the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| Name and | Year | Salary ($) | Bonus ($) | Stock Awards (S) | Option Awards (S) | Other Compensation ($) | Total ($) | |||||||||||||||||||||

| Phillip Kumnick | 2020 | 85,813 | 64,980 | 127,500 | 1,033,333 | 1,311,626 | ||||||||||||||||||||||

| Chairman of the Board and Former CEO and President (1) | 2019 | - | - | - | - | - | - | |||||||||||||||||||||

| Philip Beck | 2020 | 138,889 | - | - | 308,104 | 446,993 | ||||||||||||||||||||||

| Former Chairman of the Board. CEO and President (2) | 2019 | 350,000 | - | - | - | 350,000 | ||||||||||||||||||||||

| Thomas Szoke | 2020 | 275,000 | - | - | - | - | 275,000 | |||||||||||||||||||||

| Chief Solutions Architect and a Former Director | 2019 | 275,000 | - | - | - | - | 275,000 | |||||||||||||||||||||

| Stuart Stoller | 2020 | 237,500 | - | 127,500 | - | 365,000 | ||||||||||||||||||||||

| CFO (4) | 2019 | 237,500 | - | - | - | 237,500 | ||||||||||||||||||||||

| Stock | Option | Non-Equity Incentive Plan | All Other | |||||||||||||||||||||||||||||

| Salary | Bonus | Awards | Awards | Compensation | Compensation | Total | ||||||||||||||||||||||||||

| Name and Title | Year | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||||

| Phillip Kumnick | 2022 | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Chairman of the Board, Former CEO and President (1) | 2021 | 65,939 | - | 127,500 | 2,201,498 | - | - | 2,394,937 | ||||||||||||||||||||||||

| Thomas Thimot | 2022 | 325,000 | - | - | - | 5,271 | 330,253 | |||||||||||||||||||||||||

| CEO (2) | 2021 | 168,542 | - | - | 5,272,000 | 75,000 | - | 5,515,542 | ||||||||||||||||||||||||

| Cecil Smith III | 2022 | 275,000 | - | - | 437,650 | - | 6,198 | 718,848 | ||||||||||||||||||||||||

| President and CTO (3) | 2021 | 140,073 | 50,000 | - | 2,636,000 | 75,000 | - | 2,901,073 | ||||||||||||||||||||||||

| Thomas Szoke | 2022 | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Chief Solutions Architect and Former Director (4) | 2021 | 252,083 | - | - | 138,000 | 206,250 | 305,000 | 901,333 | ||||||||||||||||||||||||

| Stuart Stoller | 2022 | 110,681 | - | - | - | - | - | 110,681 | ||||||||||||||||||||||||